Equity markets, bond markets, and REITs are all seeing a September swoon, as higher rates are leading to selloffs. We saw something similar occur last year, only to have the 4th quarter be quite strong for the equity markets, so we’ll see how things turn out. Earnings season starts once again in about 2-3 weeks, which usually bodes well for us to see a bit of a recovery as the actual businesses are doing quite well, despite dire sentiment around many of the cheaper areas of the market. This is why we always want to take a longer-term perspective with our investments, to weed out the noise of short-term drama. For instance, when we buy a bond yielding 7.5%, the matures in say 5 years, we are locking in a fixed income return of 7.5% per annum that matures in 2028, where we will get our money back. However, if interest rates perk up .25%, that bond might fluctuate in price by a few % points, despite nothing to do with the actual company. Fortunately, we were not buying bonds when rates were extremely low, as those that did have taken enormous losses. For example, the government of Austria sold a .85% coupon bond with a 100-year maturity in 2020. That bond now trades at 35 cents on the dollar, down from a high of 136 cents when it had a negative yield. Charlie Bilello pointed out that the longest duration bond ETF is now down 62% from its peak in 2020, as the 30-year Treasury yield has moved from an all-time low of .8% in March 2020 up to 4.7% today.

Bonds are much more attractive in today’s environment, and we have locked-in some very robust yields, so we’ll collect the coupon payments and ultimately, I do think rates will peak fairly soon, which should help bond prices recover, so we want to make sure we have enough allocated to them during this period of opportunity. There are a lot of things that just don’t add up in the current economy. Housing prices have never been less affordable. If homeowners were forced to refinance at today’s interest rates, many people would not be able to afford the payments. Thankfully, most people locked-in fixed rates, but the result is some of the lowest existing home sales in history, because people can’t afford new mortgage rates if they give up their current rate. This does not seem very sustainable to me in the long-term. In addition, the government debt and fiscal deficits are so incredibly large that higher rates have a devastating impact, as more and more of the budget must be dedicated to making interest payments. If the government reduces spending on some of the more stimulative initiatives, the economy will feel the sting, and in a recession, we will likely see rates drop again.

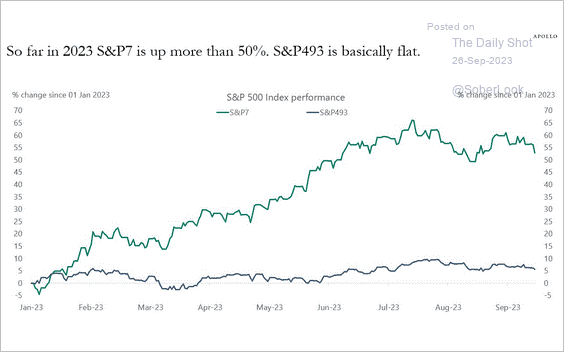

I’ve written to you many times this year about the complete and utter bifurcation of the equities market, where nearly all the performance is from the 7 or 8 largest technology stocks. To put this into perspective as can be seen on the image in the top of this email, the top 7 stocks in the S&P are up more than 50% on the year. The bottom 493 stocks in the S&P 500 are virtually flat, only up slightly. One of those magnificent 7 is Apple, whose P/E multiple has risen 45% YTD, moving from 20x to 29x, even though its revenue and net income have both declined (pointed out by Andrew Kuhn). This is a very similar dynamic to what we saw in 2020 and many of the same stocks dominating the market this year, are the ones that were down huge in 2022, but stock performance is greatly exceeding actual underlying business performance, likely making them very susceptible for a major decline.

The S&P 600 index is an index comprised of stocks that range in market capitalization from $850MM to $5.2B. This diversified index is 22% below its 2021 highs, only up 2% YTD, and is flat for five years going back to September 2018. Small cap stocks have really been left out of any major rally and are trading at some of the cheapest levels relative to large cap stocks in their history. Keep in mind that small cap stocks have actually outperformed large cap stocks over the long run, so things are very stretched currently towards these 7 or 8 behemoths benefitting from the AI tailwinds. Major disconnects from historical relative valuations can occur for a prolonged period of time, but ultimately, they tend to mean revert. Mean reversion would be a massive tailwind for us, as we have never had a portfolio that features higher dividend and interest yields as our current ones do, combined with very strong financial strength and low valuations. It’s not a good time to be selling value stocks or bonds unless you have to, but it could be a good time to realize profits on some of the more tech-focused large caps. We have done so over the year by reducing and hedging our positions in Google, META, and Amazon. Those stocks all got quite cheap and are great businesses, but I don’t think the opportunity now is nearly as good as it was a year ago. Other areas of the market where we are more heavily invested have much stronger potential risk-adjusted return potential in our opinion. This email has been quite long as I wanted to provide some context into what we are seeing. This isn’t a normal market, and many industries and sectors are trading at very extreme levels. I think we have many levels of protection and I’m excited to see what we can produce over the next 12-24 months, as I think we could see some pretty explosive moves, as quite a few of our stocks feel like coiled springs at these levels. Lastly, I’ll be launching a radio program in October with my friend, insurance/financial planning expert, and colleague Bruce Weinstein. It will be regional and also posted online on all the streaming services, so I’ll keep you posted as that launches.